Commbank Deposit Atm

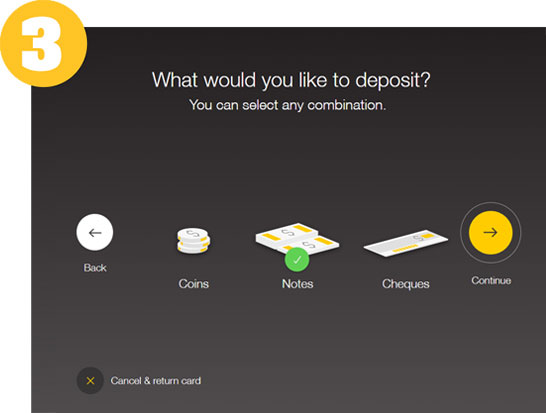

The CommBank app also sends an SMS with a Cash PIN. You need to use both numbers within 30 minutes to withdraw cash from the CommBank ATM. If you or someone else don’t get there in time, your money will be returned to your account. You will have to register your phone number using the CommBank app to receive the Cash PIN. Our instant deposit ATMs enable you to choose how to put money into your account, even when the bank is closed https://www.commbank.com.au/digital-banking/de.

COMMONWEALTH BANK Visa Debit Card is the bank’s newest card product that allows you to shop online, pay bills, and make purchases over the phone . The card can be used in millions of retail outlets and at more than 1.9 million ATMs worldwide where the Visa Logo is displayed.- Commonwealth Bank provides ATM card and ATM machine that can meet your Banking needs anytime. Broad ATM Network Do your banking transactions in all Commonwealth Bank Indonesia ATM and all ATMs in Prima, Bersama, Cirrus, and CBA ATM network.

- Customers will be able to deposit a maximum of $10,000 into a CommBank ATM in a single day, down from $20,000. Australia's biggest bank Commbank has today announced it is halving its daily limit.

- Create your ATM Deposit Code online (only available for business accounts) In the CommBank app: Log on to the CommBank app, tap the top left menu then ATM Deposit Codes; In NetBank: Log on to NetBank and click Transfers & BPAY then ATM Deposit Codes; In CommBiz: Log on to CommBiz, click Accounts then ATM Deposit Codes.

Our Visa Debit cards are available to Personal and Business current account customers. The new Visa Debit card allows you to access money from your Current Account wherever you are in the world: in shops, at ATMs and online, wherever you see the Visa logo displayed. Visa Debit Card provides real advantage over the standard ATM card for everyday purchases and lots more.

FEATURES & BENEFITS

Visa Debit offers you more benefits, greater convenience and more security and protection.

Benefits for you:

- Greater worldwide acceptance

- Wider online acceptance

- Greater convenience when you shop

- Verified by Visa – great security online

- Greater consumer protection

- Use your own money linked to your deposit account wherever you are.

- Allows online purchase, in-store and by phone

- Just swipe and sign for your in-store transactions local or international.

- Access cash at ATMs here overseas.

- Allows bill payments using the card number.

- Allows you to transfer funds via COMMONWEALTH BANK .

- Enjoys Visa’s security and worldwide card acceptance.

- Balance Inquiry

Banking Solutions for Study in Australia

AusStudent is an individual savings account denominated in IDR and AUD for parents who will send their children to continue their study in Australia or for parents who have children who curently are studying in Australia

Benefits:

| - | Affordable initial deposit and fees, including free transfer fee to Commonwealth Bank of Australia (CBA) Account through the branch of Commonwealth bank of Indonesia. |

| - | Competitive interest rate in which calculated based on end of day daily balance. |

| - | Convenient transactions in more than 180,000 Debit Prima/BCA network and more than 40,000 ATM across Indonesia. |

| |

| - | Freedom in transaction through Internet/Mobile Banking with discount for transaction fee including: |

| |

| - | Open a CBA account for the children prior to arrival in Australia. |

| - | Free withdrawal fee at CBA ATM using the Commonwealth bank of indonesia ATM card. |

| - | Free transfer fee to CBA account*. |

| - | Special AUD Exchange Rate. |

| - | Monthly statement. |

*Free transfer fee applies for customers who fulfill the minimum balance requirement of IDR 10,000,000 and AUD 1,000 within the same month of the fund transfer. This free transfer facility is not applied for transaction through branch, through Internet Banking / Mobile Banking only applied for 3x every month.

Risk of Product

The risks attached to this savings product is the change of fees and interest rates that can be done at anytime and it will be informed to customers through branches, website or other media deemed appropriate by the Bank.

Procedures and Requirements

Opening an account can be done at the nearest Commonwealth Bank branch by completing and signing the account opening application form and providing the required documents.

Document Requirement:

| For Parents | For Children |

|

|

Fees & Charges*

| Keterangan | Biaya | |

| IDR | AUD | |

| Initial deposit | IDR10.000.000,- | AUD 1.000 |

| Minimum average balance | IDR5.000.000,- | AUD 500 |

| Monthly administration | IDR5.000,- | AUD 0.5 |

| Below minimum average balance fee | IDR50.000,- | AUD 5.0 |

| Hold balance | IDR100.000,- | AUD 10 |

| Stamp duty | In accordance to the prevailing regulations. Stamp duty is charged per CIF, not per account | |

| Closing account fee | IDR50.000,- | AUD 8 |

*Fees and Charges is subject to change and it will be informed to customers through media deemed appropriate by the Bank

If you have auto debit facility on Commonwealth Bank (for example: AutoInvest, loan installment, standing instruction, standing order, etc), please ensure that your accounts have sufficient balance to cover the monthly fees and auto debit facilities.

Commbank Opening Hours

Interest Rate Calculation

Interest is calculated based on end of day balance according to the prevailing interest rate. Interest rate table can be accessed in here

Commbank Deposit Atm Bonus

Product Expiration

The expiry of the product will be when customer or Bank closes the account.

Product Issuer

This Product issued by PT Bank Commonwealth and guaranteed by Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS')***

Commbank Deposit Atm Debit Card

***If the value of total deposit exceeds maximum value/if the interest rate of deposit exceeds interest rate of Indonesia Deposit Insurance Cooperation/Lembaga Penjamin Simpanan ('LPS'), deposit is not included and/or shall not be guaranteed by LPS in Deposit Insurance Scheme/Program Penjaminan Simpanan.