Boc Bank Fixed Deposit Rates

| Items | Service Charges / Fees |

|---|---|

| Returned cheque Insufficient funds HKD / USD cheque RMB cheque Other reasons HKD / USD cheque RMB cheque RMB cheque amount exceeding RMB80,000 | HK$150 / US$18 per returned cheque RMB200 per returned cheque HK$50 / US$6.5 per returned cheque RMB50 per returned cheque RMB200 per returned cheque |

| Mark 'good' cheque Dispatched by The Bank | HK$200 per cheque (Plus drawee bank charges) |

| Dispatched by customer | HK$60 per cheque |

| Stopped payment order | HK$100 per instruction HK$100 / US$13 / RMB80 per instruction (Through Corporate Internet Banking) |

| Special-printed cheque | The Bank reserves the right to levy charges |

| Special-printed deposit slips | The Bank reserves the right to levy charges |

| Cheque book delivery By ordinary mail By registered mail | Waived HK$25 / US$3 / RMB20 plus non-local postage (postage will be waived if delivery address is in HK) |

| Dishonoured cheque returned by registered mail | HK$25 / US$3 / RMB20 per cheque plus non-local postage (postage will be waived if delivery address is in HK) |

| Account closed within 3 months after account opening | HK$200 per account |

| Monthly fee Average monthly balance in the “Swiss Franc” (“CHF”) in the Current Account exceeds CHF 500,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 1.00% per annum of the average monthly balance of CHF in the current month. The monthly service fee will be calculated in CHF. (Only applicable to corporate customers) |

| Average monthly balance in the 'Danish Krone' ('DKK”) in the Current Account exceeds DKK4,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 0.85% per annum of the average monthly balance of DKK in the current month. The monthly service fee will be calculated in DKK. (Only applicable to corporate customers) |

| Average monthly balance in the 'Swedish Krona' ('SEK”) in the Current Account exceeds SEK5,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 1.00% per annum of the average monthly balance of SEK in the current month. The monthly service fee will be calculated in SEK. (Only applicable to corporate customers) |

| Average monthly balance in the 'Euro' ('EUR”) in the Current Account exceeds EUR5,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 0.40% per annum of the average monthly balance of EUR in the current month. The monthly service fee will be calculated in EUR. (Only applicable to corporate customers) |

| Combined average monthly balance in HKD current account(s) and savings account(s) below HK$5,000 (Only applicable to corporate customers) | Waived (Only applicable to corporate customers) |

| Temporary Overdraft / Overdrawn Unauthorized overdraft HKD USD RMB | HK$120 per cheque and O/D interest calculated at prime rate plus 10% or overnight HIBOR (whichever is higher) US$15 per cheque and O/D interest calculated at US prime rate plus 10% or overnight LIBOR plus 4% (whichever is higher) RMB120 per cheque and O/D interest calculated at CNY prime rate plus 10% or overnight CNY HIBOR plus 10% (whichever is higher) |

In excess of overdraft limit

| HK$120 per cheque and O/D interest calculated at prime rate plus 10% or overnight HIBOR (whichever is higher) US$15 per cheque and O/D interest calculated at US prime rate plus 6% or overnight LIBOR plus 4% (whichever is higher) RMB120 per cheque and O/D interest calculated at CNY prime rate plus 10% or overnight CNY HIBOR plus 10% (whichever is higher) |

| Against uncleared items | HK$120 / US$15 / RMB120 per cheque |

- Boc Bank Fixed Deposit Rates

- Boc Bank Loan Rate

- Boc Fixed Deposit Promotion

- Boc Interest Rate

- Boc Fd Rate

- Boc Bank Exchange Rate Today

| Items | Service Charges / Fees |

|---|---|

| Replacement of a passbook | HK$100 per account |

| Account closed within 3 months after account-opening date | HK$50 per account |

| Monthly fee Average monthly balance of 'Swiss Franc' ('CHF') in the savings or multi-currency account exceeds CHF500,000.00 (Only applicable to corporate customers) | Subject to a monthly fee based on 1.00% per annum of the average monthly balance of CHF. The monthly fee will be calculated in CHF. (Only applicable to corporate customers) |

| Average monthly balance of the 'Danish Krone' ('DKK”) in the DKK Savings Account or Multi-Currency Savings Account exceeds DKK4,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 0.85% per annum of the average monthly balance of DKK in the current month. The monthly service fee will be calculated in DKK. (Only applicable to corporate customers) |

| Average monthly balance of the 'Swedish Krona' ('SEK') in the SEK Savings Account or Multi-Currency Savings Account exceeds SEK5,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 1.00% per annum of the average monthly balance of SEK in the current month. The monthly service fee will be calculated in SEK. (Only applicable to corporate customers) |

| Average monthly balance of the 'Euro' ('EUR') in the EUR Savings Account or Multi-Currency Savings Account exceeds EUR5,000,000.00 (Only applicable to corporate customers) | Subject to a monthly service fee based on 0.40% per annum of the average monthly balance of EUR in the current month. The monthly service fee will be calculated in EUR. (Only applicable to corporate customers) |

| Combined average monthly balance in HKD current account(s) and savings account(s) below HK$5,000 (Only applicable to corporate customers) | Waived (Only applicable to corporate customers) |

| RMB savings account average monthly balance below RMB5,000 (Only applicable to corporate customers) | Waived (Only applicable to corporate customers) |

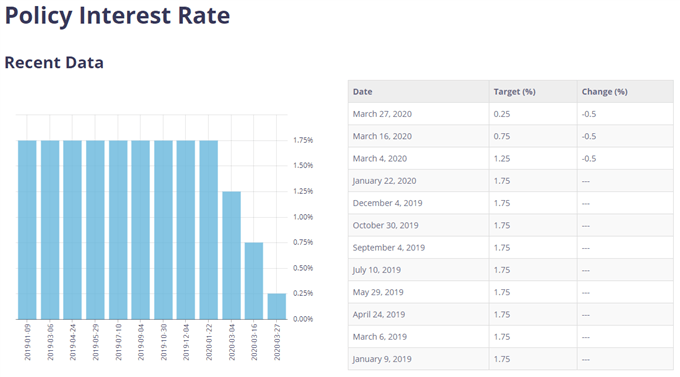

Placing a Fixed Deposit with Commercial Bank will fetch you one of the most attractive rates-of-interest in the market. If you need to place a deposit for a short period of time at a higher interest rate, Call Deposits. Established on 1 October 2001, Bank of China (Hong Kong) Limited (referred to as Bank of China (Hong Kong) or BOCHK) is a locally incorporated licensed bank. Bank of China (Hong Kong) is a leading listed commercial banking group in Hong Kong in terms of assets and customer deposits and offers a comprehensive range of financial products and services to personal and corporate customers. Compare the Best Fixed Deposit Rates Promotion in Singapore 2021. Enjoy the Highest Promotional FD Rates from top banks (up to 0.75% p.a.) this February. The Bank of Canada (BoC; French: Banque du Canada) is a Crown corporation and Canada's central bank. Chartered in 1934 under the Bank of Canada Act, it is responsible for formulating Canada's monetary policy, and for the promotion of a safe and sound financial system within Canada.

| Items | Service Charges / Fees | ||||

|---|---|---|---|---|---|

| Deposit of RMB notes into RMB account | Waived if the total daily deposit amounts transacted at branch counters per customer are within the following limits: | ||||

Private Wealth/ Wealth Management / Business Integrated Account - Elite | Enrich Banking / Business Integrated Account – Plus | i-Free Banking / Business Integrated Account | Other Customers | ||

RMB | 20,000 | 20,000 | 10,000 | 5,000 | |

| If a customer deposits an amount exceeding the above daily limit, BOCHK will charge a fee equivalent to 0.25% of the total deposit amount on that day; and the fee will be charged in HKD subject to a minimum fee of HKD50.00 per transaction. | |||||

| Foreign currency notes deposit to / withdrawal from account of its original currency (Calculated withdrawal or deposit separately) | Waived if daily deposit / withdrawal amounts transacted at branch counters per customer are within the following limits (in original currency): | ||||

| Private Wealth/ Wealth Management / Business Integrated Account - Elite | Enrich Banking / Business Integrated Account - Plus | i-Free Banking / Business Integrated Account / Other Customers | |||

| USD | 10,000 | 5,000 | 2,000 | ||

| AUD, NZD, CAD, EUR, GBP, CHF, SGD, BND, ZAR | 5,000 | 3,500 | 2,000 | ||

| JPY | 600,000 | 350,000 | 200,000 | ||

| THB | 50,000 | 35,000 | 30,000 | ||

| DKK, NOK, SEK | 20,000 | 15,000 | 10,000 | ||

| If a customer deposits / withdraws an amount exceeding the above daily limit, BOCHK will charge a fee equivalent to 0.25% of the whole deposit / withdrawal amount; and the fee will be charged in HKD, based on the prevailing telegraphic transfer exchange rate of foreign currency to HKD | |||||

Accounts / Services Application Fee (Only applicable to corporate customers)1

| Items | Service Charges / Fees | |

|---|---|---|

| Application basic fee – HK$1,200 per application, plus: | ||

| Fee for the company incorporated in Mainland China2 | HK$2,000 per application, plus the fee for conducting company search for company incorporated in Mainland China (according to the Bank’s actual costs) | |

| Fee for the company incorporated overseas3 | HK$5,000 per application, plus the fee for conducting company search for company incorporated overseas (according to the Bank’s actual costs) | |

Fee for special company:

| HK$5,000 per application | |

| Items | Service Charges / Fees |

|---|---|

| Early uplifting | If we exercise our discretion to allow uplift of time deposit before maturity, no interest will be payable and the customer must pay charges calculated based on the following formulae (whichever is higher) subject to a minimum of HKD200.00: |

| Items | Service Charge / Fee | |

|---|---|---|

| Card replacement fee Replacement due to customer's loss of a BOC Card (with HKD account as the primary account) / BOC Fast Cash Card Replacement due to customer's loss of a BOC Card (with RMB account as the primary account) Non-receipt of new card | HK$50 RMB50 Waived | |

| Replacement of a damaged card New card with HKD account as the primary account New card with RMB account as the primary account | HK$50 RMB50 | |

| Cash withdrawal via ATMs of 'JETCO' network4 | Cash withdrawal in the Mainland / Macau | HK$20 per transaction |

| Cash withdrawal via 'CUP' ATM network (Also applicable to BOC UPI Dual Currency Credit Card linked with bank accounts)5 | Cash withdrawal from RMB account | RMB15 per transaction |

| Cash withdrawal from HKD account | HK$15 per transaction | |

| ATM cash withdrawal via 'VISA / PLUS' network (Applicable to BOC Visa Credit Card linked with bank accounts)6 | HK$25 per transaction | |

| ATM cash withdrawal via 'MasterCard / Cirrus' network (Applicable to BOC MasterCard Credit Card linked with bank accounts)7 | HK$25 per transaction | |

| Items | Service Charges / Fees |

|---|---|

| Replacement of a key | HK$100 (plus key replacement cost) |

| Drilling of box and replacement of lost keys | HK$200 (plus box opening fees and lock replacement costs) |

| Items | Service Charges / Fees |

|---|---|

| Issuance of a cashier's order (HKD / USD / RMB) | HK$50 |

| Issuance of an e-Cashier's Order (HKD / USD / RMB) | HK$50 / US$6 / RMB40 |

| Verification of the purchaser's identity | Waived |

| Cancellation of cashier's order and redeposit into purchaser's account | HK$50 per item |

| Report loss of a cashier's order to HKICL | HK$50 plus HKICL charges |

| Mark 'good'-cashier's order | HK$50 per item |

| Items | Service Charges / Fees |

|---|---|

| Banker's endorsement | HK$150 (HK$20 for each additional copy) |

| Confirmation of account balance | HK$100 (HK$20 for each additional account) |

| Auditor's confirmation | HK$300 per set |

| Banker's reference letter | HK$300 (HK$25 for each additional copy) |

| Outward Remittance | ||||

|---|---|---|---|---|

| Items | Charges / Details | |||

| Telegraphic Transfer | Telegraphic Transfer | Conducted via branches | HK$210 per item8 | |

| Conducted via electronic channels | Personal customers: HK$65 per item8 Corporate customers: HK$105 per item8 | |||

| BOC Remittance Plus Remittance to branches of Bank of China and Cooperative Banks in the mainland and designated branches outside Hong Kong | Conducted via branches | HK$200 per item8 | ||

| Conducted via electronic channels | Personal customers: Waived8 Corporate customers: HK$100 per item8 | |||

| Handling Fee of Message to Beneficiary | Conducted via branches | Waived if message is within 10 Chinese characters or 10 English words; HK$100 per item if exceeded | ||

| Conducted via electronic channels | Waived | |||

| Extra Cable Charge (if more than one SWIFT/electronic message is required) | HK$100 per message | |||

| Correspondent Bank Charges9 (Applicable if remitter requested to bear correspondent bank charges) | USD | To anywhere (excluding the mainland) | HK$160 per item | |

| EUR | To Euro Area | No charge in advance if remittance amount is EUR100 or below EUR25 per item if remittance amount is EUR100.01 to Euro12,500 EUR35 per item if remittance amount is above EUR12,500 | ||

| GBP | To United Kingdom and Ireland | GBP20 per item | ||

| JPY | To Japan | Minimum JPY3,000 per item | ||

| THB | To anywhere | THB500 per item | ||

| All Others | Minimum HK$200 per item | |||

| Confirmation to Beneficiary Bank by SWIFT/electronic message | HK$100 per item | |||

| Handling charge for amendment, cancellation, return | HK$220 per item, plus correspondent bank charges10 | |||

| Enquiry on status of remittance | By SWIFT/electronic message | HK$220 per item, plus correspondent bank charges10 | ||

| By telephone call | HK$100 per item | |||

| Set up or amend Standing Instruction of general remittance | HK$100 per item, plus regular outward remittance charges | |||

Set up, execute, or amend Standing Instruction remittance of social security payments for the Elderly. | Waived | |||

| BoC Pay Cross-border Remittance | 1% of total amount for remittance (subject to a minimum fee HKD20.00 per transaction and a maximum of HKD60.00 per transaction | |||

| Demand Draft | Issuance of Demand Draft | For picking up on same day | HK$100 per item | |

| Request for Cancellation of issued Demand Draft | HK$250 per item | |||

| Request for Stop Payment and/or Report Loss of issued Demand Draft | HK$250 per item (plus an additional charge of HK$140 per item levied by HKAB, which is subject to change without prior notice) | |||

| Inward Remittance | ||

|---|---|---|

| Items | Charges / Details | |

| Proceeds credited to a BOCHK account | Remittance amount not more than HK$500 or equivalent | Waived |

| Remittance amount more than HK$500 or equivalent | HK$60 per item | |

| Mark good by other banks in Hong Kong | Telegraphic Transfer / Mail Transfer | HK$35 per item |

| Demand Draft | HK$100 per item | |

| Enquiry by SWIFT/electronic message | HK$100 per item | |

| Others | ||

|---|---|---|

| Services | Items | Charges / Details |

| Facsimile | Hong Kong (within 5 pages) | HK$50 per item |

| Outside Hong Kong (within 2 pages) | HK$100 per item | |

| Each additional page (all countries/regions) | HK$50 per item | |

| Issuance of the duplicate advice or receipt | Within 1 year | HK$50 per page |

| 1-2 years | HK$100 per page | |

| 2-3 years | HK$150 per page | |

| More than 3 years (maximum 7 years) | HK$200 – HK$350 per page | |

| Local Bank Transfer | ||||

|---|---|---|---|---|

| Items | Charges / Details | |||

| Local Bank Transfer | Express Transfer (RTGS/ CHATS) | Funds Transfer to other local banks by Express Transfer (RTGS/ CHATS) | Conducted via branches | HK$180 per item11 |

| Conducted via electronic channels | Personal customers: Waived Corporate customers: HK$25 (HKD/CNY)/HK$55 (USD/EUR) per item11 | |||

| Funds transfer from other banks by Express Transfer (RTGS/ CHATS) to a BOCHK account | Transfer amount not more than HK$500 or equivalent | Waived | ||

| Transfer amount more than HK$500 or equivalent | Personal customers: Waived Corporate customers: HK$15 per item | |||

| Handling charge for amendment, cancellation, return or enquiry10 | HK$150 per item | |||

| FPS (Faster Payment System) | Funds transfer to other local banks through FPS | Transfer amount is equal to or not more than HK$1 million or equivalent | Personal customers: Waived | |

| HKD transfer amount is equal to or not more than HK$1 million CNY transfer amount is equal to or not more than CNY$1 million | Corporate customers: HK$10 per item Corporate customers: CNY$8 per item | |||

| Funds transfer from other local banks through FPS to a BOCHK account | Waived | |||

| Handling charge for return or enquiry10 | Corporate customers: HK$150 per item Personal customers: HK$150 per item Charges on Personal Customers in this section will be waived until further notice | |||

Boc Bank Fixed Deposit Rates

| Items | Charges / Details | |

|---|---|---|

| Setup or amendment of standing instruction for autopay-out | HK$70 / RMB56 per item | |

| Returned autopay (due to insufficient funds) | Direct debit authorisation (DDA) | HK$150 / RMB130 per item |

| Standing instruction for autopay-out | HK$150 / RMB130per item | |

| Re-processing of direct debit authorisation (DDA) instruction | HK$100 / RMB90 per item | |

| Other Services | |

|---|---|

| Items | Service Charges / Fees |

| Company search | |

| Limited company Unlimited company | HK$150 HK$100 |

| Request for savings / fixed deposit account records | |

| 1 year 2 years 3 years More than 3 years (maximum 7 years) | HK$250 per account HK$750 per account HK$1,000 per account HK$1,000 per additional year |

| Request for copy of account statements (from 1 month up to 7 years from the date of request) | HK$50 per statement cycle |

| Setting up / Amendment of standing instruction | HK$70 |

| Written funds transfer instruction without using the BOCHK standard form | HK$150 per transaction |

| Provision of dupliacte copy of customer's information | HK$50 per page plus operating costs |

| Gift cheque (HKD / RMB) | HK$10 per item |

| Notional Precious Metals Passbook | |

| Replacement of passbook | HK$100 per account |

| Change of coins | |

| 10 or 20 cents Others | HK$1 for every 20 dollars HK$1 for every 50 dollars |

| Bulk coins deposit (presorting is required) | 2% of the total amount for deposit of 500 coins or above Subject to a minimum fee HK$50 per transaction |

| Bulk cash deposit / transaction (HKD)12 | 0.25% of the total deposit amount for depositing above 200 notes / above HK$100,000 via branch counters per customer per day Subject to a minimum fee HK$50 per transaction |

| Bulk cheque deposit | |

| Up to 30 pieces per day Charges for each cheque if more than 30 pieces per day | Waived HK$1 |

| Encashment of demand draft | |

Issued by Bank of China

| 0.25% of draft amount (minimum HK$50) plus correspondent bank's charge (if any) 0.375% of the draft amount (minimum HK$50) plus correspondent bank's charge (if any) HK$100 plus correspondent bank's charge (if any) and interest |

| Clean bills | |

| Sent for collection (applicable to non-bills transactions) Returned / unpaid items | HK$200 per item (including postage) plus correspondent bank's charge HK$100 plus correspondent bank's charge (if any) and interest |

Boc Bank Loan Rate

| Mortgage Loan Service | |

|---|---|

| Item | Charges / Details |

| Handling Charge13 | 0.5% of loan amount (Subject to a minimum of HK$1,000 equivalent) |

| Cancellation Fee 13 | 0.15% of loan amount (Subject to a minimum of HK$5,000 equivalent) |

| Custody of Property Title Deeds after Full Repayment | HK$3,000 per year |

| Lease Consent Letter on Charged Property | HK$1,000 per letter (plus legal cost, if any) |

| Fee for Full / Partial Principal Repayment (less than 1 month’s prior notice) | Base on repayment amount to charge 1-month interest calculating from prepayment date |

| Re-issuance of Notice for Repayment Schedule | HK$100 per copy |

| Re-issuance of Annual Statement of Instalment Loan Account | HK$100 per copy |

| Confirmation of Mortgaged Property and Account Balance | HK$200 per copy (HK$20 for each subsequent copy issued simultaneously) |

| Re-issuance of Confirmation of Mortgage / Notice for Repayment Schedule for the Mortgage Subsidizing Scheme of Hospital Authority / Government | HK$100 per copy |

| Change of Mortgage Term13 (e.g. Repayment amount, tenor, mortgage scheme14, mortgagor, guarantor and the like) | HK$1,000 per item |

| Change of Mortgage Scheme from 'All-You-Want' Mortgage Scheme / 'Smart' Mortgage Scheme to other mortgage scheme (or vice versa) | HK$2,000 for each application |

| Provision of Duplicate Copy of Deeds / Documents | HK$200 per title deed of property; HK$50 per page for other documents |

| Administration Fee for Late Payment13 | HK$500 for each overdue repayment (plus legal cost, if any) |

| Administration Fee for Government Rate / Rent Payment13 | HK$500 for each time |

| Administration Fee for the Change of Insured Amount of Fire Insurance (Applicable to the insured amount involving assessment of the reinstatement value of the property) | HKD1,000.00 for each time |

| BOC Express Cash | ||

|---|---|---|

| Item | Charges / Details | |

BOC Express Cash Instalment Loan | 0%-1.5% of total loan amount per annum (Please refer to loan advice for the actual handling fee to be charged) | |

Default Interest and Handling Fee | HK$500 late payment fee plus default interest rate of 0.1% per day on the overdue amount until the day of actual payment will be charged upon each occasion of overdue monthly repayment. | |

Early Settlement Fee | Upon early settlement of the Loan, outstanding interest and principal shall be calculated on the basis of “Reducing Balance Method16” or “Rule of 7817”. “Reducing Balance Method”: The Borrower shall also pay an early settlement fee which is 2% of the approved principal amount of BOC Express Cash Instalment Loan / Balance Transfer. The Bank may at its discretion adjust the early settlement fee at any time. “Rule of 78”: The Borrower shall also pay an early settlement fee which is 2% of the approved principal amount of the Loan; 1.5% of the amount of the approved Loan for balance transfer (in accordance with the Terms and Conditions of BOC Express Cash Instalment Loan Balance Transfer) per annum for the remaining years of the Loan Period (any part of a year shall be rounded up to a year). The Bank may at its discretion adjust the early settlement fee at any time. | |

BOC Express Cash Revolving Credit18 | Annual Fee (only applicable to the customer who apply for the BOC Express Cash Revolving Credit on or after 1 June 2009) | 1% of credit limit (subject to a minimum of HKD50.00 and a maximum of HKD1,000.00) |

Withdrawal/transaction Fee: Cash Advance19 / Balance Transfer Service19 / Cash Before Card Service19 / payment or fund transfer through “JET Payment”19 | Cash Advance / Balance Transfer Service / Cash Before Card Service / payment or fund transfer through “JET Payment” in Hong Kong: 2% of transaction amount plus HKD20.00 per transaction | |

Payment or fund transfer through “Online Bill Payment”19 | 2% of transaction amount plus HKD20.00 per transaction. | |

Minimum Payment | i) 3% of total outstanding amount (subject to a minimum of HKD40.00); and ii) any overdue minimum payment amount from previous monthly statement (where applicable); and iii) total of over-limit amount (where applicable | |

Late Payment Charge | 5% of the Minimum Payment (subject to a minimum of HKD100.00 and a maximum of HKD200.00) for each late payment. | |

Returned Cheque / Rejected Autopay Charge | HKD150.00 per transaction | |

Over-limit Handling Fee20 | HKD100.00 per statement period | |

Statement Copy Retrieval Fee • Within the latest 2 months Free • Preceding the latest 2 months HKD50.00 per copy | ||

Sales Slip Retrieval Fee | HKD30.00 per copy | |

Lost Card Replacement Fee | HKD100.00 per card | |

Foreign Currency Cheque Repayment Fee | HKD100.00 per cheque | |

Credit Balance Refund | HKD50.00 per transaction | |

Credit Reference Letter | HKD200.00 per copy | |

| Other Loan Services (Personal Customer) | ||

|---|---|---|

| Item | Charges / Details | |

| Secured Loans | Handling Charge | 0.2% of loan amount (Subject to a minimum charge of HKD250 or equivalent) |

| Renewal Fee | 0.2% of loan amount (Subject to a minimum charge of HKD250 or equivalent) | |

| Unsecured Loans(Non- BOC Express Cash Instalment Loan & Revolving Credit) | Handling Charge | 0.5% of loan amount (Subject to a minimum of HK$1,000) |

| Renewal Fee | 0.25% of loan amount (Subject to a minimum of HK$500) | |

| Commitment / Arrangement Fee for Overdraft Limit | 0.5% p.a. on undrawn overdraft limit (calculated on a daily basis) | |

| Administration Fee for Late Payment | HK$500 for each overdue repayment (plus legal cost, if any) | |

| Provision of Duplicate Copy of Deeds / Documents | HK$200 per title deed of property; HK$50 per page for other documents | |

Remarks:

- 'Accounts/Services Application Fee' is applicable to corporate customers (which generally refers to non-individual customers), who newly open an account or service with the Bank. 'Tax-exempt Charities', 'Social Service Organizations' and 'Government and Related Organizations' are exempted for the fee. For details, please contact staff of the Bank.

- 'Company incorporated in Mainland China' refers to corporate customers incorporated in accordance with the relevant laws of the People's Republic of China, regardless of whether such customer is registered as non-Hong Kong companies under Companies Ordinance of Hong Kong (Cap 622) Part 16.

- 'Company incorporated overseas' refers to corporate customers incorporated in accordance with laws other than Hong Kong or the People's Republic of China, regardless of whether such customer is registered as non-Hong Kong companies under Companies Ordinance of Hong Kong (Cap 622) Part 16.

- For transaction conducted via the 'JETCO' network, if the transaction currency is Renminbi, the transaction amount is converted at the exchange rates set by the 'JETCO' member bank which is displayed on the ATM screen at the time of the transaction.

- For transaction conducted via the 'CUP' network, if the transaction currency is Hong Kong dollars or Renminbi, the transaction amount is converted at the exchange rates set by BOCHK at the time of the transaction (exchange rate can be enquired via the website of BOCHK). If the transaction currency involves currency other than Hong Kong dollars or Renminbi, the transaction amount is converted directly at the daily exchange rates set by China UnionPay at the time of the transaction (Exchange rate can be enquired via the website of China UnionPay).

- For transaction conducted via the 'VISA / PLUS' network through bank account, the transaction amount withdrawn is converted into Hong Kong dollars at the daily exchange rates set by VISA at the time of the transaction plus 1.95% conversion charge (Exchange rate can be enquired via the website of VISA).

- For transaction conducted via the 'MasterCard / Cirrus' network through bank account, the transaction amount is first converted to US dollars, and then to Hong Kong dollars, at the daily exchange rates set by MasterCard at the time of the transaction plus 1% conversion charge (Exchange rate can be enquired via the website of MasterCard).

- In addition to relevant charges to the remittance item, if the Remitter pays the remittance amount by the Remitter’s BOC Credit Card, BOC Credit Card (International) Limited will in addition charge an administration fee for remittance by credit card and debit it to the BOC credit card account. For details please refer to the Fee Schedule of respective BOC Credit Card.

- 'Correspondent Bank Charges' means collectively the charges imposed by the related correspondent banks, intermediary banks, clearing institutions &/or beneficiary bank in processing the remittance, plus extra handling charge of the Bank. If Correspondent Bank Charges are requested to be borne by remitter, the Bank is entitled to collect the charges in advance. The collected amount is not refundable. But, if the actual claims exceeded the collected amount, the Bank is entitled to collect the shortfall. Please also note that this charge option requires more work and the related banks/institutions generally collect higher amount than if they are otherwise borne by beneficiary.

- (a) The handling charge of the Bank is not refundable regardless of whether the request is fulfilled. (b) Correspondent banks and/or the beneficiary bank may levy their handling charges in relation to the request; the Bank may collect these charges in advance or arrears.

- If Beneficiary Bank Charges are requested to be borne by remitter, the Bank is entitled to collect the charges plus extra handling charges of the Bank in advance. The chargeable amount is determined by the Bank with reference to the collection records of the related beneficiary bank without notice, and the collected amount is not refundable. But, if the actual claims exceeded the collected amount, the Bank is entitled to collect the shortfall. Please also note that this charge option requires more work and the Beneficiary Bank generally collect higher amount than if they are otherwise borne by beneficiary.

- Bank of China (Hong Kong) Limited reserves the rights to levy extra charge.

- Not applicable to customers of Home Ownership Scheme and Tenant Purchase Scheme.

- For the change of mortgage scheme involving “All-You-Want” Mortgage Scheme/ “Smart” Mortgage Scheme, please refer to the relevant service fee item.

- The above charges are subject to revision from time to time.

- “Reducing Balance Method” :applicable to any loan application on or after 13 January 2020 for BOC Express Cash Instalment Loan / BOC Express Cash Instalment Loan Balance Transfer / BOC Express Cash Instalment Loan Top up / BOC Express Cash Instalment Loan Balance Transfer Top Up or any loan application on or after 7 June 2020 for BOC Express Cash Instalment loan online application with instant approval service.

- “Rule of 78”:applicable to the loan application on or before 12 January 2020 for BOC Express Cash Instalment Loan / BOC Express Cash Instalment Loan Balance Transfer / BOC Express Cash Instalment Loan Top up / BOC Express Cash Instalment Loan Balance Transfer Top Up or any loan application on or before 6 June 2020 for BOC Express Cash Instalment loan online application with instant approval service.

- Only applicable to customers who have applied for BOC Express Cash Revolving Credit on or after 1 June 2009.

- Any withdrawal or fund transfer of the credit balance or any part thereof from BOC Express Cash Revolving Credit account, except effected by way of a refund procedure prescribed by Bank of China (Hong Kong) Limited (the 'Bank') from time to time, will be treated as a cash advance transaction.

- If the current balance exceeds the credit limit of the Revolving Credit, an Over-limit Handling Fee will be debited to the account.

- Annualised Percentage Rate (APR):

Loan Amount

APR

HKD 5,000.00

As low as 14.23%

HKD 20,000.00

As low as 10.74%

HKD 100,000.00

As low as 7.99%

An APR is a reference rate which includes the basic interest rates and other fees and charges of a product expressed as an annualised rate. This APR is calculated based on a loan amount of HKD5,000.00/HKD20,000.00/HKD100,000.00 and a yearly interest rate of 12.5%/9.5%/7.0% respectively. The APR is calculated according to the guidelines issued by The Hong Kong Association of Banks and for reference use only. The actual APR will depend on the customer’s credit rating and loan amount.

- Annualised Overdue/Default Interest Rate is 46.78%. Additional yearly flat interest rate of 4% will be applied to outstanding loan balance on a compound basis, if you have failed to meet the requirement of Minimum Payment on two or more occasions in respect of the last 6 consecutive statements ('Triggering Event'). Default Interest Rate will be applied during the period from the day following the statement date of the statement first issued after the occurrence of the Triggering Event until the statement date of the statement first issued after the cessation of the Triggering Event. Interest will be calculated at the applicable privileged interest rate thereafter. Any special offers (such as preferential interest rates) applicable to the account will be suspended until such time as the Default Interest Rate ceases to apply. In any case, the relevant promotion period will not be extended.

Other Charges may apply, please contact our staff for details.

We reserve the right to amend the service charges.

Smart Fixed Deposit

Boc Fixed Deposit Promotion

Enjoy a fixed rate of interest on your deposit for a period of your choice.

Smart Fixed Deposit

Place your money for a fixed period of time and enjoy the certainty of knowing exactly how much interest you are going to earn.

- Deposits can be fixed for 12 , 36 or 60 months

- The interest rate is fixed throughout the term of the deposit

- Minimum deposit £ 10,000/= and Maximum £ 500,000/=

- Interest will be paid only at the maturity

- Premature withdrawals will be allowed only on the following circumstances

- Death of the account holder

- Financial distress of the account holder subject proving to the satisfaction of the bank In the case of a premature withdrawal, interest will be calculated at our variable savings account interest (currently 0.25 % p.a.) for the completed period of the deposit

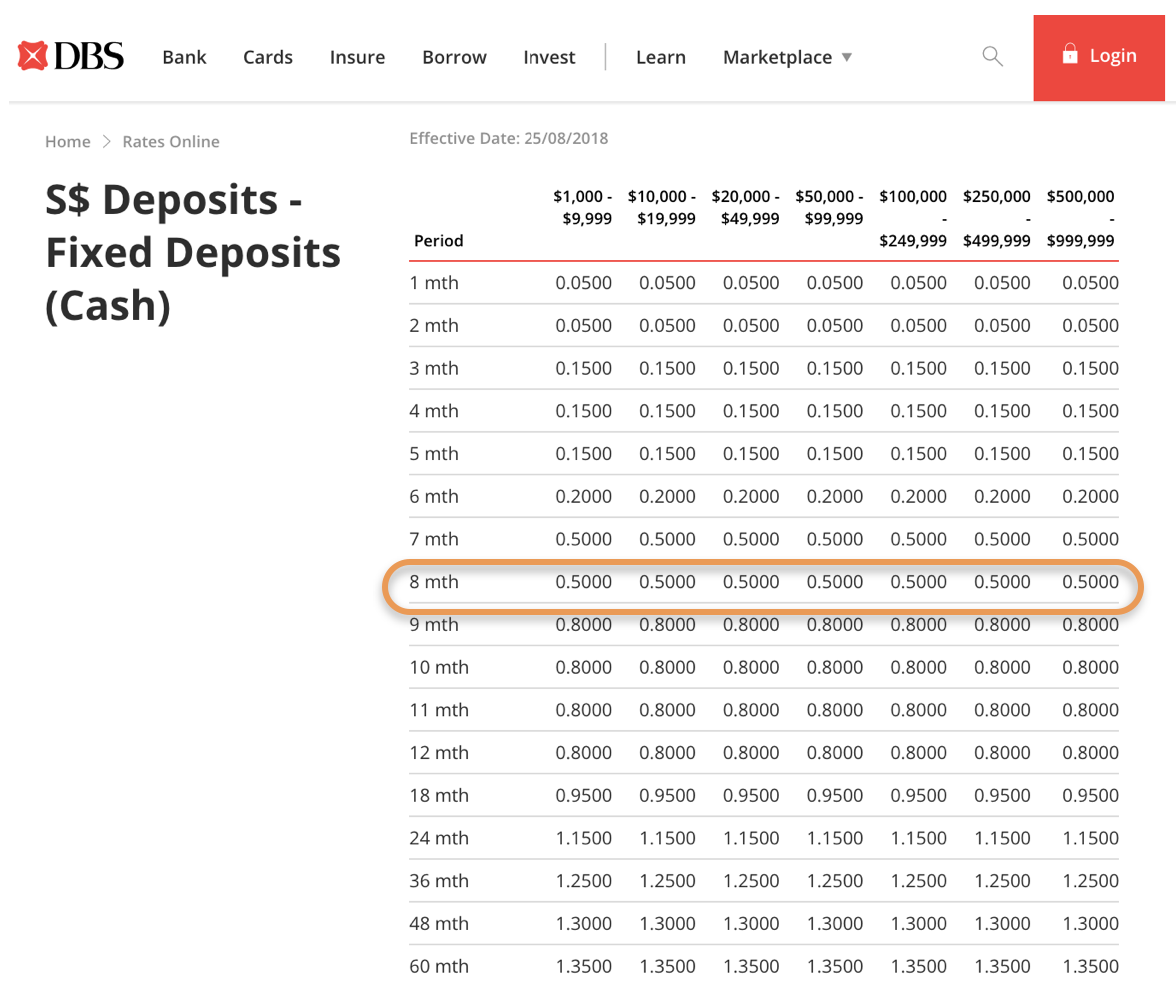

Interest Rates

GBP Deposits

| Amount | 12 Months (At maturity Gross/AER) | 36 Months (At maturity Gross/AER) | 60 Months (At maturity Gross/AER) |

|---|---|---|---|

| £10,000 & Above | 1.00% | 1.25% | 2.00% |

All the above are subject to Bank’s standard terms and conditions. For more information please contact us

Contact

Boc Interest Rate

- +44 20 3195 5187

- +44 20 7377 5430

- Click 2 email

Downloads

- Application

Take it easy with eCash

Send money to Sri Lanka with peace in mind

| We Buy |

|---|

| GBP |

| USD |

Important Information

Boc Fd Rate

Products offered by Bank of Ceylon, Sri Lanka are not authorised and regulated by the FCA/PRA. Therefore rules made under the Financial Services and Markets Act 2000 for the protection of customers do not apply. Protection afforded by the UK regulatory system, including the Financial Services Compensation Scheme (FSCS) will not apply.

Boc Bank Exchange Rate Today

Bank of Ceylon (UK) Ltd only acts as an introducer to Bank of Ceylon, Sri Lanka.